How Payday Loans can bridge financial gaps responsibly

Wiki Article

Cash Money loans Explained: Just How to Be Eligible and the Benefits of Selecting the Right Type

Cash loans act as a convenient financial tool for people facing unanticipated costs. However, their ease of access usually relies on certain eligibility criteria, such as credit rating and revenue confirmation. By comprehending the various sorts of money loans offered, customers can make informed decisions that straighten with their financial scenarios. This understanding can lead to much better financing terms and enhanced monetary security. What factors should be considered prior to obtaining a cash money finance?Understanding Money Financings: What They Are and Just how They Work

Money loans are an economic tool created to give immediate access to funds for people encountering unexpected expenditures or urgent economic demands. These loans normally include obtaining a details quantity of money, which the borrower agrees to settle over a collection period, generally with rate of interest. The application procedure for cash money loans is generally uncomplicated, needing minimal documents and frequently enabling fast approval.Lenders evaluate the customer's revenue, credit reliability, and settlement capacity, yet lots of money loans do not need considerable credit history checks, making them obtainable to a wider audience. Commonly, funds are disbursed swiftly, occasionally within the very same day.

Understanding the terms of payment, including rate of interest and prospective charges, is vital for debtors. Responsible management of money loans can relieve monetary stress and anxiety; nonetheless, careless loaning can lead to a cycle of debt. It is vital for debtors to assess their financial situation prior to continuing with a cash money loan.

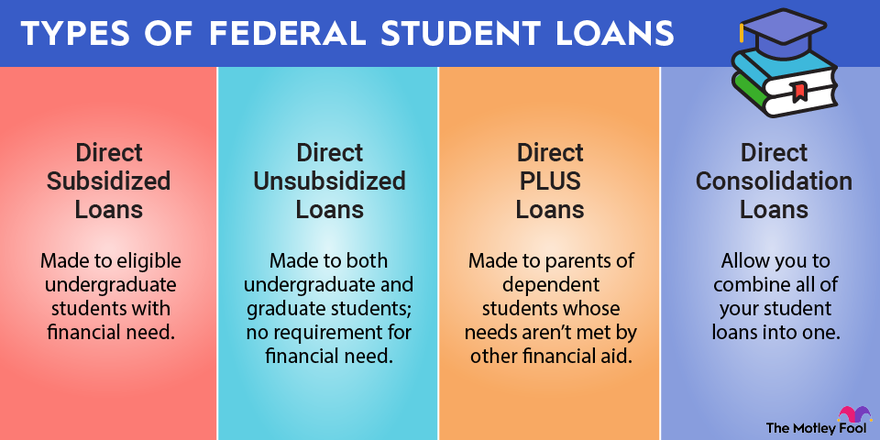

Sorts Of Money loans Offered

Cash money loans been available in various forms, each catering to different monetary requirements. Personal loans supply flexibility for an array of costs, while payday advance provide fast accessibility to funds with details payment terms. Additionally, title loans take advantage of vehicle equity, offering an additional alternative for borrowers looking for instant cash money.Individual loans Introduction

Personal loans encompass a variety of monetary items designed to satisfy private loaning requirements. These loans are commonly unsecured, meaning they do not call for security, enabling borrowers to accessibility funds without running the risk of possessions. Common kinds of individual loans include fixed-rate fundings, where the rates of interest stays consistent throughout the payment period, and variable-rate loans, which can change based upon market conditions. In addition, some individual loans may be designated for details objectives, such as financial debt consolidation, home enhancement, or clinical costs. Debtors often appreciate the versatility of personal finances, as they can be made use of for different financial objectives. Recognizing the various sorts of personal loans assists individuals select the most appropriate alternative for their situations and economic objectives.Payday Advance Includes

Amongst the different choices offered for acquiring funds, payday financings stand out as a particular kind of cash money lending designed to address short-term economic needs. These loans usually feature tiny amounts, commonly ranging from $100 to $1,500, which customers can access quickly, typically within a solitary business day. Repayment terms are short, generally requiring complete payment by the consumer's following payday, therefore the name. Rates of interest can be substantially greater than conventional lendings, reflecting the danger connected with temporary financing. Additionally, cash advance usually require marginal documentation, making them accessible to people with poor credit rating. Debtors ought to come close to these loans carefully due to the potential for high charges and the risk of debt cycles if repayment is not taken care of correctly.Title Financing Conveniences

Title loans offer distinctive benefits for people seeking fast access to cash money, especially for those that own a lorry. These loans allow consumers to take advantage of their lorry's equity, frequently providing a bigger amount than conventional personal fundings. The application process is generally simple and fast, with minimal credit rating checks, making it accessible for those with inadequate credit report. Furthermore, debtors can maintain using their automobiles throughout the loan period, which provides benefit. Title loans likewise have a tendency to have reduced rate of interest rates compared to payday advance loan, making them an extra budget-friendly option for urgent monetary requirements. In general, title loans can be a sensible option for people needing prompt funds without giving up car ownership.Trick Qualification Criteria for Cash Loans

Credit History Demands

Revenue Confirmation Refine

Earnings verification is an essential part in the qualification evaluation for cash money lendings, as it gives lending institutions with insight right into a borrower's economic stability. This procedure normally includes sending documents that validates revenue resources, such as pay stubs, income tax return, or financial institution statements. Lenders assess this information to identify whether the consumer has a consistent income that can sustain lending payment. Freelance people might need to supply additional paperwork, like earnings and loss statements, to confirm their incomes. The earnings confirmation process assurances that loan providers make notified choices, lowering the danger of default. Inevitably, conference income confirmation needs is crucial for borrowers looking for cash car loans, as it substantially affects their opportunities of authorization.Examining Your Financial Situation Before Using

Exactly how can a private efficiently assess their economic situation before looking for a money loan? They must analyze their regular monthly revenue and expenditures to determine disposable revenue. This entails providing all incomes and categorizing expenditures into dealt with (lease, utilities) and variable (amusement, groceries) expenses.Next, examining existing financial obligations is necessary. A person ought to determine their complete financial obligation responsibilities, consisting of charge card, personal fundings, and any kind of various other economic commitments. This action assists identify the debt-to-income proportion, which loan providers often consider when assessing car loan applications.

Furthermore, it is very important to assess savings and emergency funds. Having a monetary cushion can indicate a responsible monetary strategy. Finally, people must set a reasonable borrowing restriction based upon their ability to pay off the car loan without threatening their financial security. This thorough evaluation aids in making informed decisions and improves the probability of financing authorization.

The Importance of Credit Rating in Money Car Loans

A strong credit rating functions as an important indicator of a person's monetary dependability when obtaining money lendings. Lenders use credit history to evaluate the customer's history of handling debt, which consists of timely settlements and existing financial obligation degrees. Usually, a greater credit rating signals reduced risk, potentially resulting in extra favorable lending terms, such as lower interest prices. Alternatively, people with poor credit rating may face higher rates or perhaps rejection of their car loan applications.In addition, credit report ratings influence the quantity of cash a lending institution agrees to prolong. A durable rating may permit debtors to access larger funding amounts, while those with weak scores could be limited to smaller amounts. As a result, comprehending the relevance of maintaining a healthy credit report rating can significantly influence one's loaning experience and financial alternatives in times of demand.

Benefits of Selecting the Right Cash Car Loan Type

Which cash car loan type is most ideal for a debtor's specific demands can greatly influence their financial health. Picking the right money car loan kind can result in reduced rates of interest, much more favorable repayment terms, and an overall workable economic concern. For instance, individual loans often provide larger quantities with longer repayment durations, making them excellent for considerable costs like home repairs or medical costs. Payday loans supply fast access to cash money for immediate requirements yet generally come with higher costs.Selecting one of the most appropriate lending kind can additionally enhance a borrower's credit scores profile if they preserve timely payments. Furthermore, comprehending the nuances of different loans permits borrowers to avoid risks such as exhausting themselves or falling under debt traps. Ultimately, making an informed option encourages customers to fulfill their financial obligations while lessening anxiety and maximizing the prospective benefits of their cash money funding.

Tips for Efficiently Handling Your Money Funding

Efficiently handling a cash financing requires a proactive technique, especially after picking the appropriate funding type. Initially, debtors ought to create a thorough repayment plan, outlining regular monthly repayments and due dates to prevent late costs. Maintaining a budget that represents these settlements is important to assure funds are offered when needed.Furthermore, it is recommended for customers to communicate with their lending institution proactively. If financial problems develop, reviewing prospective services, such as bargaining or restructuring the car loan settlement Installment Loans terms, can reduce stress. Checking the funding's rate of interest and terms is likewise significant; borrowers might consider re-financing alternatives if better rates appear.

Lastly, prompt payments play a substantial duty in preserving a positive credit rating. By adhering to these strategies, individuals can effectively navigate their cash finance obligations, assuring monetary security while avoiding unnecessary penalties and fees.

Regularly Asked Concerns

How much time Does It Take to Get Authorized for a Cash Financing?

Can I Make An Application For Numerous Cash loans at As Soon As?

Yes, individuals can make an application for numerous cash loans all at once. This method might impact credit report ratings and loan providers' perceptions. Care is suggested to avoid exhausting financial obligations and ensure manageable repayment termsWhat Takes place if I Default on a Cash Loan?

If a private defaults on a cash money funding, they might encounter significant repercussions, consisting of damages to credit history, increased rate of interest, potential lawsuit, and the loss of collateral if safeguarded by properties.Are There Fees Associated With Money Fundings?

Yes, cash money loans frequently feature fees, consisting of source charges, late settlement fees, and prepayment penalties. Debtors must thoroughly review all terms to fully understand the costs related to their loans.Can I Settle My Cash Money Finance Very Early Scot-free?

Many loan providers permit consumers to settle cash loans early without fines. Fast Cash. However, it's essential for individuals to review their financing contracts, as some lenders might impose charges for very early repayment, influencing general savingsTypical kinds of individual loans consist of fixed-rate car loans, where the rate of interest price stays constant throughout the repayment duration, and variable-rate car loans, which can rise and fall based on market problems. Amongst the numerous choices readily available for obtaining funds, payday loans stand out as a specific type of cash money lending developed to attend to short-term financial requirements. These loans allow debtors to utilize their vehicle's equity, often giving a bigger amount than typical personal lendings. Title loans likewise often tend to have lower interest prices contrasted to payday car loans, making them a much more inexpensive choice for immediate monetary demands. Efficiently managing a cash financing needs an aggressive technique, particularly after selecting the best car loan type.

Report this wiki page